Synergy REI offers a savvy approach to real estate investing.

The mission of our firm is to help you obtain a bright financial future.

Synergy REI is a Commercial Real Estate Investing platform specialized in value-add opportunities on assets located in growth markets across the US.

What can investors expect from us?

We adhere to strict underwriting guidelines on each deal we evaluate. If the property passes a series of our stress tests, we set out for an acquisition. Once we have the property under contract, we conduct an extensive due diligence process to determine why we wouldn’t like to move forward with the acquisition. If there isn’t sufficient cause to terminate the deal after our due diligence, we explore moving it forward. Thereafter, we share the approved opportunity with you and invite you to invest.

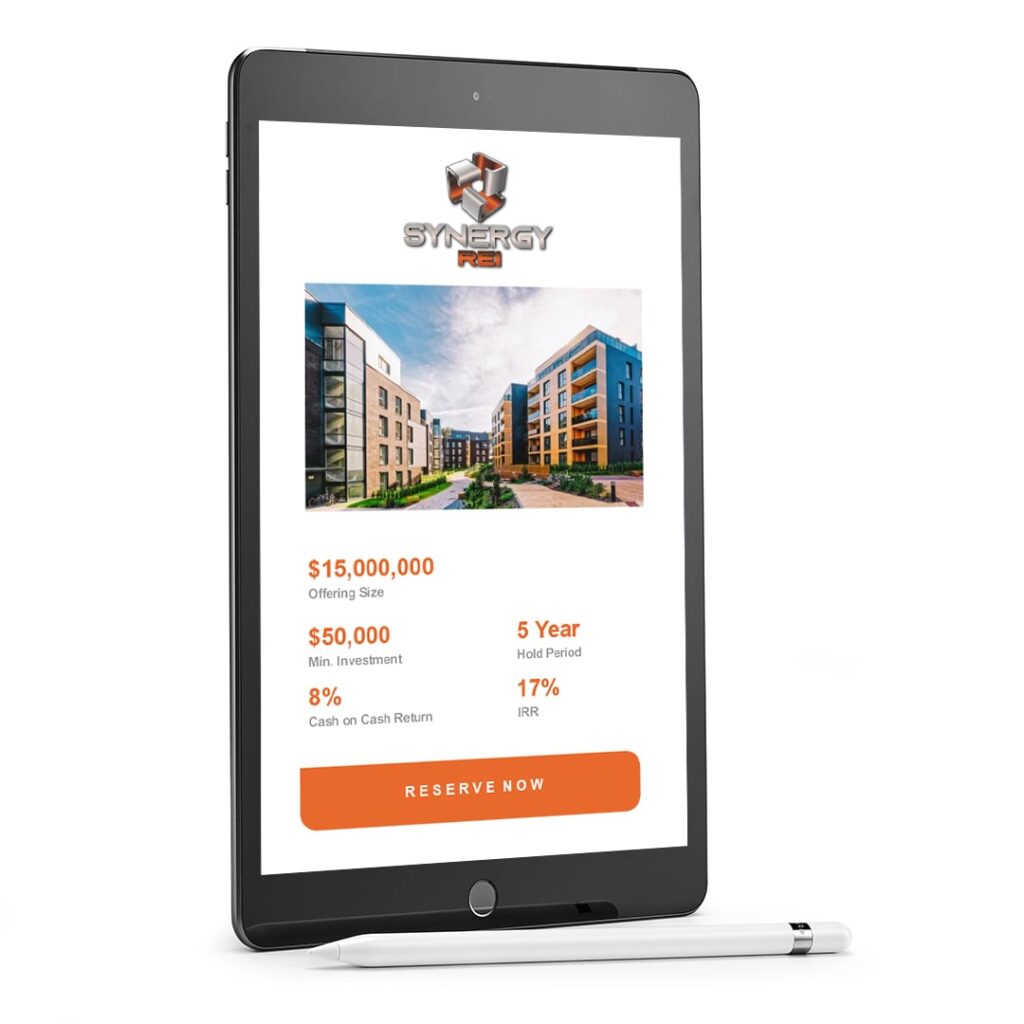

Within our investment portal you can review and sign all documents as well as see your portfolio’s ongoing performance. You will receive monthly reports on the property to evaluate and compare with our pro forma projections. We keep you informed every step of the way.

We adhere to strict underwriting guidelines on each deal we evaluate. If the property passes a series of our stress tests, we set out for an acquisition. Once we have the property under contract, we conduct an extensive due diligence process to determine why we wouldn’t like to move forward with the acquisition. If there isn’t sufficient cause to terminate the deal after our due diligence, we explore moving it forward. Thereafter, we share the approved opportunity with you and invite you to invest.

Within our investment portal you can review and sign all documents as well as see your portfolio’s ongoing performance. You will receive monthly reports on the property to evaluate and compare with our pro forma projections. We keep you informed every step of the way.

Partner Portfolio

Smart Wealth Equity offers our investors the opportunity to invest in high performance real estate. We only partner with experienced syndicators with a proven history of success.

$200M+

Portfolio Size

2000+

Total Units

The Allure

268 Units

The Joseph

192 Units

The Mila

124 Units

The 10Forty8

128 Units

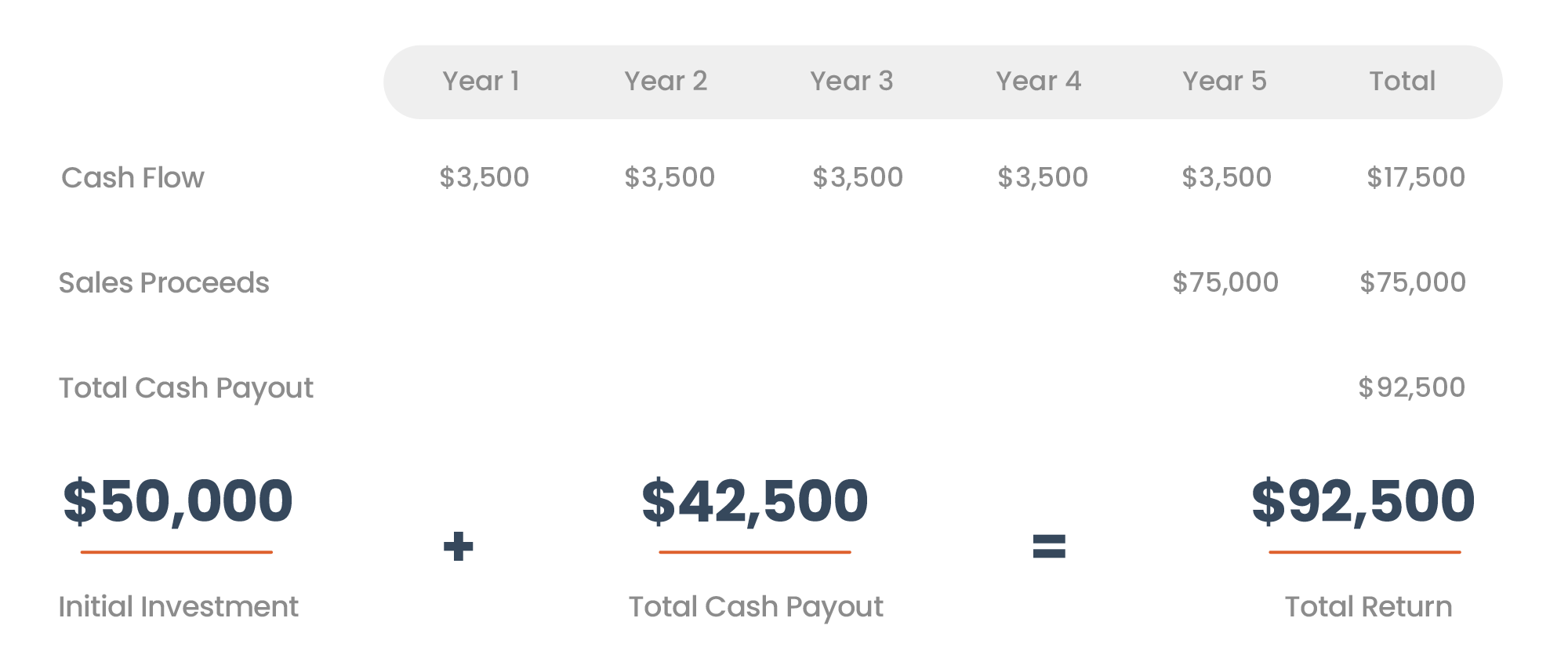

Investment Calculator

The information displayed on this page is strictly for informational purposes and does not guarantee future results. Select the investment options below to see sample investment returns.

5 Years

Hold Period

7%

Preferred Return

17%

Projected Avg. Annualized Return (AAR)

What is

Real Estate Syndication?

A Real Estate Syndication is a partnership between the GPs

(General Partners/deal sponsors) and the LPs (Limited Partners/investors) that combines an experienced

team with investor capital to purchase commercial real estate assets, execute a business plan, and share

in the profits.

How It Works

Learn about the full investment cycle and the power of implementing the snowball effect to achieve your passive income goals.

1.

We Purchase

We find the deal, negotiate the purchase, perform the due diligence,

form a business plan, arrange the debt, and close the deal.

2.

You Invest

Investors review the business plan, projected returns, and subscribe to the

offering.

3.

We Reposition

We execute the business plan to increase the property’s value.

4.

You Cash Flow

We collect rents and distribute profits (monthly or quarterly) to

investors. Mailbox money!

5.

Disposition/Refinance

We refinance or sell the property and return our investor’s

capital plus any additional profits.

6.

Your Reinvest

Through our offerings, you continue to build wealth and achieve your

financial goals.

Client review will be here. Client review will be here. Client review will be here. Client review will be here. Client review will be here. Client review will be here. Client review will be here.

Client review will be here. Client review will be here. Client review will be here. Client review will be here. Client review will be here. Client review will be here. Client review will be here.

Client review will be here. Client review will be here. Client review will be here. Client review will be here. Client review will be here. Client review will be here. Client review will be here.

Previous

Next

Why Work With Us

Learn more about the power of this investment vehicle and why the wealthy love real estate investing.

Stability

Real estate is backed by real assets and historically less volatile than the stock market.

Tax Benefits

Depreciation, bonus depreciation, and cost segregation are just some of the tax benefits you and your CPA will enjoy.

Appreciation

Increasing the property’s net operating income drives up the value that we capture on the refinance or sale of our property. Bottom line: more money in your pocket upon exit.

Cash Flow

Tenants pay monthly rent which covers all expenses and provides profit to investors.

Amortization

Tenants pay down the debt which increases the property’s equity.

Other Ways to Invest

Did you know you can also use your existing 401k or IRA to invest in real estate? Ask us how.

Ready to Invest?

We offer a strategic approach to investing in growth markets in the United States. Our investors benefit from owning real estate through syndication offerings, an investment vehicle geared to offer attractive annualized returns, depreciation, and cash flow.